Revisited: FDA's AI Medical Device Approvals

About a year ago, I dug into FDA’s newly-released list of its AI medical device approvals. In that post, I noted some surprising findings: AI approvals were (1) becoming more concentrated, with a small group of companies winning a large percentage of the approvals, and (2) most approvals were going to established medical device titans, like Siemens and GE, rather than to startups. Both findings showing that AI in medicine was providing sustaining innovation for established companies more than disrupting the established ecosystem.

A few weeks ago, FDA provided new data:

October 19, 2023 update: 171 Artificial Intelligence and Machine Learning (AI/ML)-Enabled Medical Devices were added to the list below. Of those newly added to the list, 155 are devices with final decision dates between August 1, 2022, and July 30, 2023, and 16 are devices from prior periods identified through a refinement of methods used to generate this list.

With this release, I wanted to see if my earlier findings still held, how fast innovation was accelerating, how quickly were more companies getting involved — and what other surprises lay within the data.

Anti-exponential: medical AI innovation is not accelerating

Scoring points: approvals by year

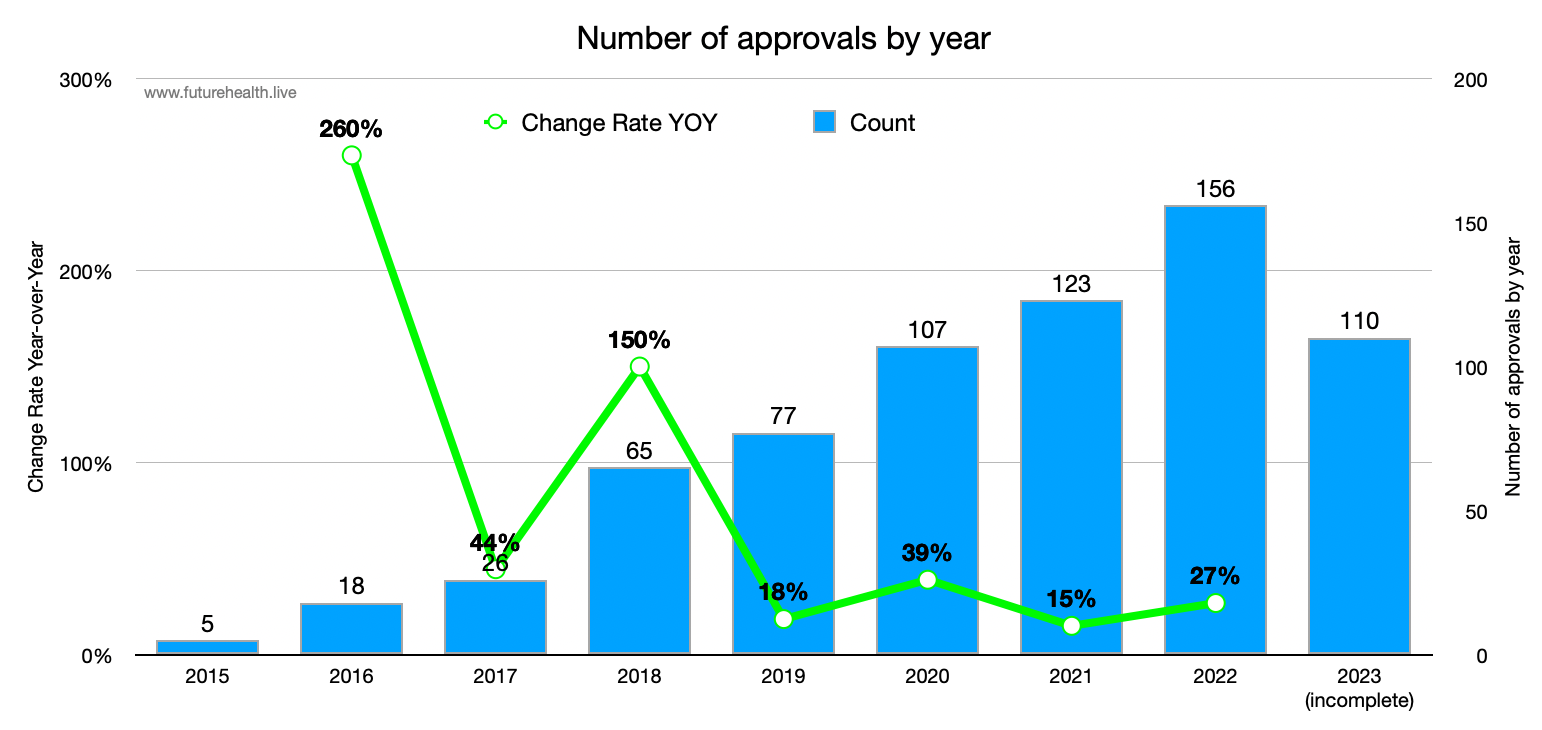

Probably most interest of all findings is that AI innovation in medicine — at least by the measure of AI device approvals — isn’t accelerating at all! The graph below shows good, steady growth in approvals per year (an average 26% increase per year over the last 4 complete years) but not acceleration:

Of course the number of approvals depends on at least two variables: how many applications are submitted, and how many are approved. It’s possible that the rate of invention (i.e. the creation of new algorithms and tools) is accelerating but that the FDA approval process is the rate limiter.

Joining the team: new companies per year

In terms of broadening the group of innovators, the list this year includes 19 entities that previously had not appeared, including stalwarts of diagnostics like Beckman Coulter and Biomerieux:

LabStyle Innovations Ltd.

Matakina Technology Ltd.

Monarch Medical Technologies

Pathwork Diagnostics Inc.

QView Medical, Inc.

Renalytix AI, Inc.

Stratoscientific, Inc.

Tyto Care Ltd.

Zepmed, LLC

AgaMatrix Inc.

AlgoMedica

Appian Medical Inc.

Beckman Coulter, Inc.

Biomerieux, Inc.

Bruker Daltonics, Inc.

ClearView Diagnostics Inc.

Cydar Ltd.

Gauss Surgical Inc.

IRIS Intelligent Retinal Imaging Systems, LLC

Liked approvals per year, this is an increase but not an acceleration. As shown in this graph:

So neither the number of approvals nor the number of companies winning those approvals is accelerating.

Less lonely at the top

Last year I noticed that approvals were becoming more concentrated — with only 18% of companies on the list gaining more than half of total approvals (this became 20% with revision of the list by the FDA; see notes at bottom). So far in 2023, you’ve got to include 30% of total companies to get to 50% of total approvals — so approvals are going to a broader group. Hard to say from the data whether this is a trend or just variation year to year, and I’ll plan to revisit when next year’s data comes out.

Your grandfather’s medical AI?

Age of the players

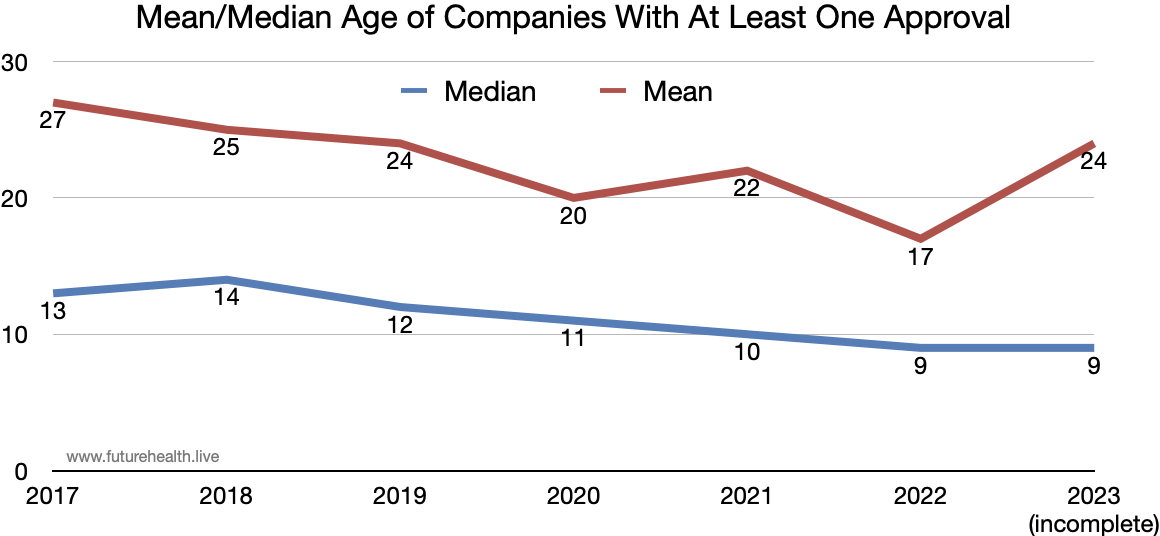

I was surprised last year to find that the average age of the top 6 companies in the approvals list (including all years) was 89 years!

The most surprising point hidden in the dataset was that a lot of the action in medical AI isn’t coming from Big Tech companies known for AI like Apple or Amazon or Google/Verily but from much much older Big Med Tech industrial companies, with GE (founded 1892) and Siemens (founded 1847) taking the number 1 and 2 spots, respectively.

That has changed a bit. The top 12 companies for 2022-23 have an average age of 58 years - so we can count that as a major shift towards new players like Annalise-AI (4 years old), Viz.ai (7 years old), Hyperfine (9 years old), and Aidoc (7 years old).

This is also reflected in the continued drop in the median age of companies receiving at least one approval, as shown in the graph below.

The bump in average age for 2023? That’s in part from the addition to the list of Cedars-Sinai Medical Center (founded 1902) and MD Anderson Cancer Center (founded 1941). Will such venerable institutions continue to move onto the list? Given the accumulated medical knowledge there, let’s hope so.

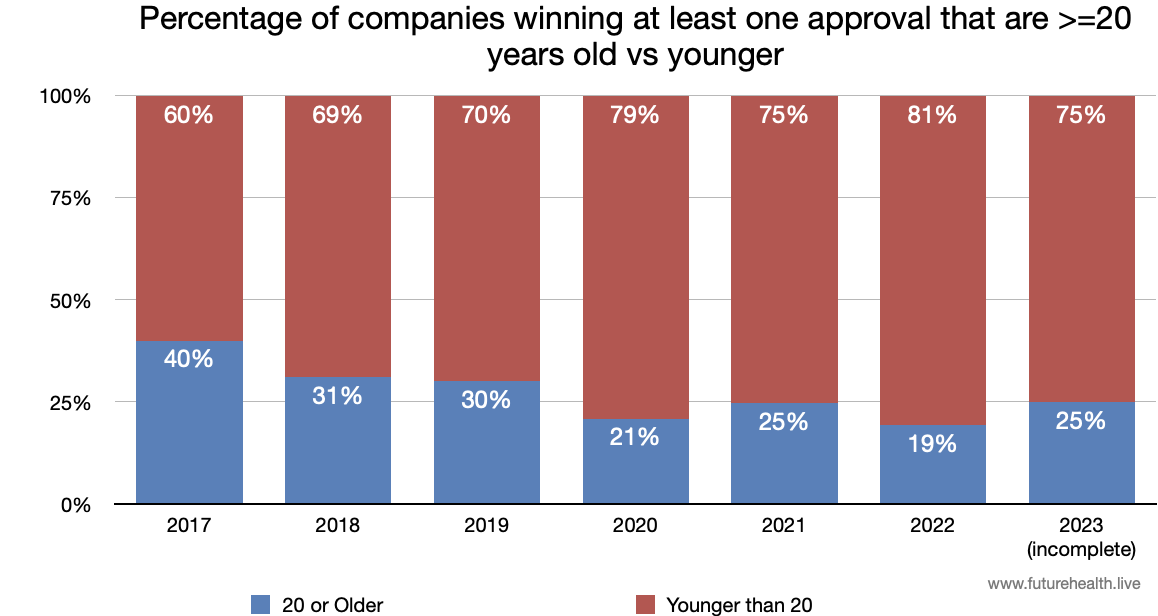

The graph above just looks at the age of companies “in the game,” with at least one approval. But that means that for 2022, for example, it counts GE, with 17 approvals, the same as United Imaging — with just one.

The graph below gives us more insight into that game, showing what percentage of players are “older” (>= 20 years) versus younger.

Points scored by young vs old

It’s also important to know whether older vs younger players are racking up points (i.e. approvals). And here we see that despite the influx of younger companies the older companies are more than holding their own. In fact, as noted last year, the percentage of approvals going to older companies is steady or possibly increasing.

Big tech MIA

Note that although older companies are holding their own, those companies mostly aren’t Big Tech. Since 2017, Apple’s only gotten 2 approvals, Google’s Verily 2, Microsoft 1, and Amazon 0. That’s a total of 5 out of 531 approvals: less than 1%.

What’s it all mean

At least on the medical side, as measured by FDA AI device approvals, AI innovation is chugging along — but not accelerating. This comes as a bit of a useful corrective to the relentless AI hype. It also raises the question as to whether the rate-limiting factor here is the FDA approval process itself (not hard to believe considering the slow pace of drug approvals), or something intrinsic to the market.

More companies are entering the space and getting approvals. Most of these are younger, but the entrance of MD Anderson and Cedars-Sinai stands as an example for the well-established hospital systems; an example which I hope will spur more participation from the healthcare establishment not just in adopting AI innovation but in helping to create it.

The percentage of approvals going to the older companies is, if anything, increasing. This is classic sustaining innovation in the medical device space, as companies like GE add AI components to improve their existing product line. It remains to be seen who in the space will start to significantly outpace the innovation at those older companies and seriously disrupt the space.

Finally, despite great stated and demonstrated interest in health, Big Tech is still not a major presence on FDA’s list. Given the health moves made by Apple, Google, Amazon, Microsoft and others, this is a little surprising — especially on the Apple side, given their focus on device innovation. Will this change, whether through in-house innovation or acquisition? Time will tell.

Notes

I’m definitely not an FDA expert, just a doctor and tech guy trying to figure out what’s going on in the world. If you’ve got special insight into any of this, or corrections to the above, please let me know.

The FDA’s AI list appears to be incomplete, leaving out at least 4 de novo approvals utilizing AI that I was able to find by cross-checking other FDA references: one from 23andMe, one from Apple, one from Renalytix AI, and one from Viz.ai. Those 4 are in FDA’s searchable approvals database, but not in their AI list. I’ve included those four in the analyses above.

The FDA’S list includes this note: “Of those newly added to the list, 155 are devices with final decision dates between August 1, 2022, and July 30, 2023, and 16 are devices from prior periods identified through a refinement of methods used to generate this list.”

I was unable to find out when these two companies were founded, and so they’ve been left out of age calculations. If you know, please share!